The venture capital model that has become synonymous with Silicon Valley isn’t inherently bad, but its current application has led to a series of problems that are now coming to light. The model’s core objective is to back high-risk, high-reward companies that can potentially provide large returns in a short period of time. This works in theory, but the emphasis on rapid scaling, huge valuations, and investor-driven pressure results in a system that often prioritizes growth over sustainability.

1. Unsustainable Growth and Burnout:

One of the most glaring issues in the current venture capital system is the obsession with growth at all costs. Silicon Valley’s venture capitalists have cultivated a “grow fast or die” mentality. This culture incentivises startups to aggressively acquire users and expand operations quickly, regardless of whether the product is ready for market or even solves a meaningful problem. When a startup is under intense pressure to show growth and attract more capital, it often sacrifices the long-term viability of its product for short-term gain. A businesses high burn rate is a perfect example of how this model can be disastrous. Venture capitalists may keep pouring money into companies even as they hit walls, hoping for a breakthrough, but eventually, the lack of true innovation and the pursuit of vanity metrics (users, revenue, etc.) leads to failure.

2. Innovation Without Impact:

The “move fast and break things” mentality that has defined Silicon Valley has led to an environment where companies create products that often have little to no meaningful impact on society. The focus is on the idea of disruption for disruption’s sake, rather than solving real-world problems. This has led to an explosion of products that, while technically impressive, fail to resonate with consumers or address actual needs. This results in a lot of wasted resources—time, energy, and capital—on ideas that never reach their full potential. Silicon Valley’s obsession with unicorns and billion-dollar valuations may produce a few winners, but it also results in countless products that either fail to deliver or are left behind when the next shiny object emerges.

3. Investor-Controlled Direction:

Silicon Valley’s venture capital model has created an environment where investors, rather than entrepreneurs, often control the direction of the company. The pressure to meet milestones and achieve massive valuations sometimes leads founders to lose sight of their original vision. Startups frequently pivot to align with investor demands for quicker returns, even if these changes dilute their core value proposition. In many cases, this compromises the innovation process and leads to business models that are more about pleasing investors than creating groundbreaking products.

4. Short-Term Thinking and Unrealistic Expectations:

Venture capitalists are often pressured to deliver returns on their investments within a relatively short time frame—usually five to seven years. This leads to a focus on short-term results at the expense of long-term sustainability. Companies are pushed to grow quickly to reach an exit point, whether through an acquisition or an IPO. In many instances, this short-term thinking has led to bloated valuations that are unsustainable. When the market doesn’t respond as expected, the company crashes, often leaving employees, customers, and even investors with little to show for their efforts.

Wasteful Capitalism: A System That Doesn’t Always Reward Innovation

The waste generated by Silicon Valley’s venture capital system isn’t limited to failed companies. It’s a systemic issue that pervades the entire ecosystem. The focus on rapid growth, profit maximization, and endless scaling often ignores the social and environmental costs of technological innovation.

1. Environmental Impact:

The environmental footprint of Silicon Valley’s rapid growth and constant technological churn cannot be ignored. From the vast data centers required to sustain the growing tech giants to the e-waste produced by constantly updated devices and hardware, the environmental costs are staggering. Yet, venture capital firms continue to fund companies that, while promising huge financial returns, do little to address their environmental impact. This represents a failure to incorporate sustainability into the innovation process. The tendency to overfund companies with little regard for their environmental footprint contributes to a growing problem that will only worsen with time.

2. Income Inequality and Job Losses:

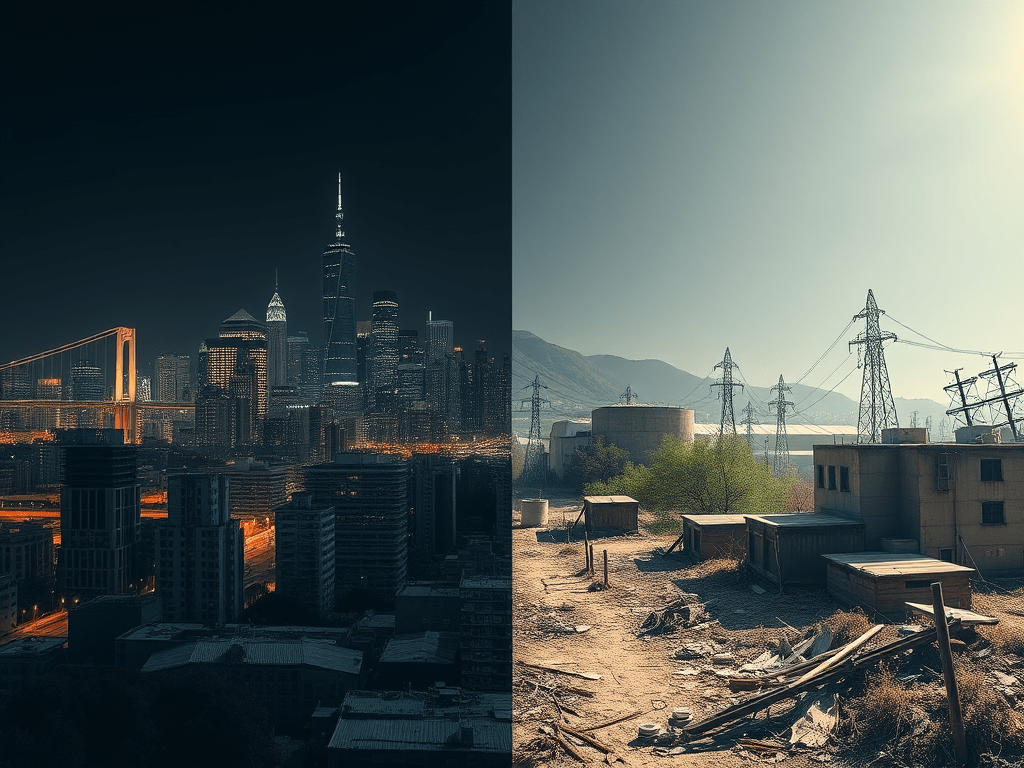

While venture capitalists and startup founders profit from the rapid rise and fall of tech companies, the workers on the ground often don’t reap the same rewards. The culture of rapid scaling and constant change has resulted in job instability, with employees frequently laid off or left to deal with the aftermath of a failed venture. Furthermore, Silicon Valley’s focus on high-tech industries has neglected the broader economy, leading to a growing divide between the tech elite and the rest of society. Capitalism, in this case, doesn’t always reward the innovation that benefits the many, but rather, it reinforces a system that disproportionately benefits the wealthy.

3. Overfunded Ideas and Market Saturation:

In a system where billions of dollars are continually poured into the tech industry, market saturation becomes inevitable. Countless companies are vying for the same markets with similar ideas, all in a race to reach profitability before their competitors do. This creates an environment where innovation is stifled by the sheer volume of redundant ideas and overfunded products. Often, it’s not the best product that wins, but the one with the most investor backing or the largest marketing budget. This results in a market flooded with “me-too” products that add little value and waste significant resources.

The Path Forward: Rethinking Venture Capital and Innovation

The collapse of companies, along with the ongoing inefficiencies of Silicon Valley’s venture capital model, provide an opportunity for change. While venture capital will remain an essential part of the startup ecosystem, it’s clear that a rethinking of the model is necessary.

1. Fostering Sustainable Growth:

Rather than prioritizing rapid growth, the tech industry needs to place more emphasis on sustainable development. This means encouraging companies to focus on creating products that deliver real value over the long term, rather than rushing to hit short-term milestones. Venture capitalists need to acknowledge that growth doesn’t always mean success and that sustainability should be a key metric for investment.

2. Prioritizing Social Impact:

The next wave of innovation should prioritize social good alongside financial returns. Rather than simply focusing on profitability, companies should be encouraged to think about how their innovations impact society, the environment, and the economy. Venture capitalists should actively seek out investments that align with this vision and demand more accountability from their portfolio companies.

3. Shifting the Power Dynamics:

Silicon Valley must address the imbalance of power between investors and founders. While investors play a crucial role in providing capital, entrepreneurs should be given more autonomy to guide their companies according to their own vision. A more collaborative relationship between investors and founders, rather than one driven by pressure for immediate returns, will lead to more sustainable innovation.

4. Supporting Diverse Ideas and Founders:

The current venture capital system has been criticized for being overly focused on a narrow set of ideas and founders, often from similar backgrounds. To truly innovate, venture capital needs to embrace diversity—both in terms of the ideas it funds and the people it backs. This would create a more dynamic, inclusive ecosystem that produces a wider range of ideas and innovations.

Conclusion

There are many cautionary tales of the wasteful tendencies inherent in Silicon Valley’s venture capital-driven ecosystem. The relentless focus on speed, growth, and scaling has led to inefficiencies, environmental harm, and societal inequality. If Silicon Valley is to continue being a global hub for innovation, it must rethink how it fosters and funds startups. By shifting toward sustainable growth, prioritizing social impact, and empowering founders, Silicon Valley can begin to fix the wasteful aspects of its capitalist model and cultivate innovation that benefits everyone, not just the few.

The deep-seated flaws in Silicon Valley’s current venture capital structure should not be seen as an indictment of capitalism itself, but rather as a call for evolution. As the tech industry continues to shape the future, it is up to all of us—investors, founders, and consumers—to demand that innovation serves a broader purpose: not just profit, but a positive impact on society as a whole.